Modigliani Miller These 1 : Reproduced Figure 2 From Modigliani And Miller 1958 Download Scientific Diagram

And fixed costs were 40000. These 1-Bs replace that fixed wiring scheme with a more sophisticated pair of variable controls that allow you.

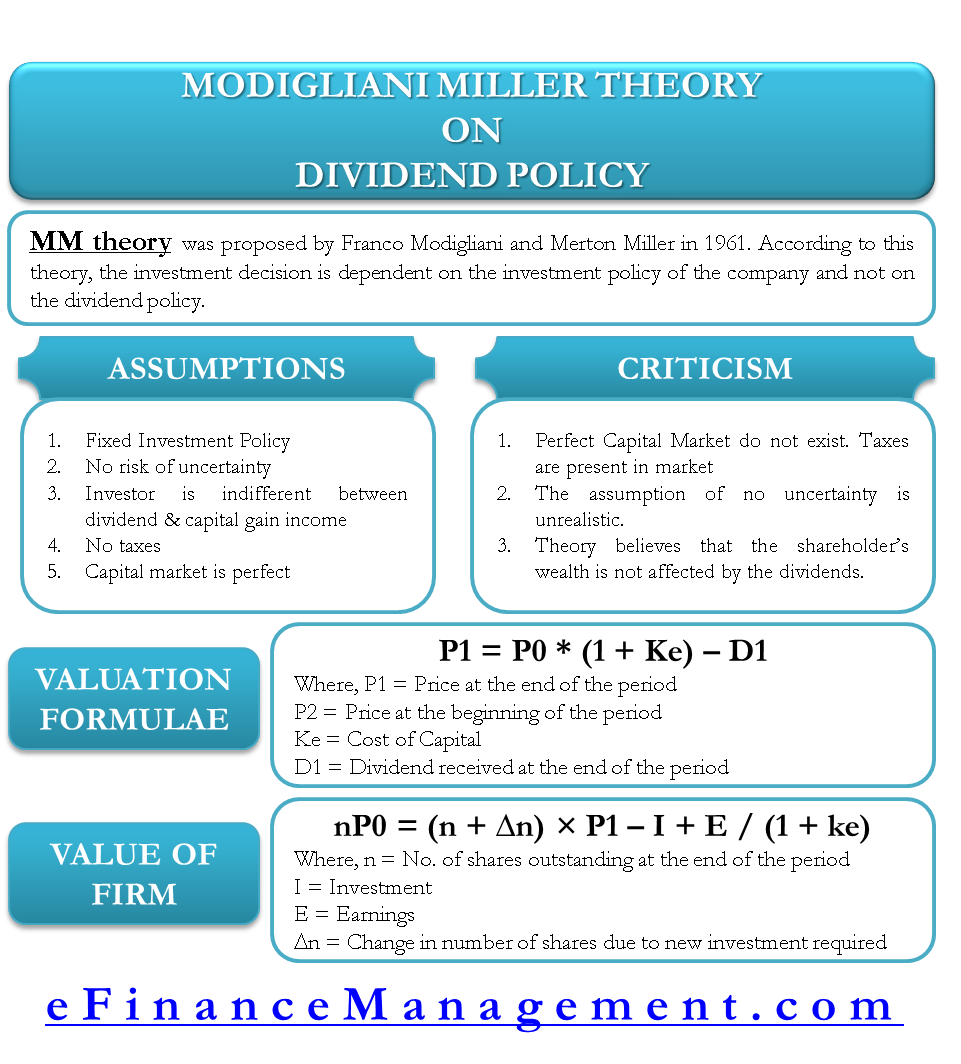

Mm Theory On Dividend Policy Focusing On Irrelevance Of Dividend

Require quantitative answers to exactly these kinds of questions.

Modigliani miller these 1. The obvious violation of Modigliani-Miller equality is federal deposit insurance. The initial items for the FIS N 49 were based on the. The bonds make semiannual payments.

Because the universitys enrollment is capped ebit is expected to be. Materials and Procedure Stage 1. STUDENT 1 RESPONSE.

Sales were 1100000 last year. What factors influence a firms business risk. Curi-ously the early tests almost always accepted the model whereas subse-.

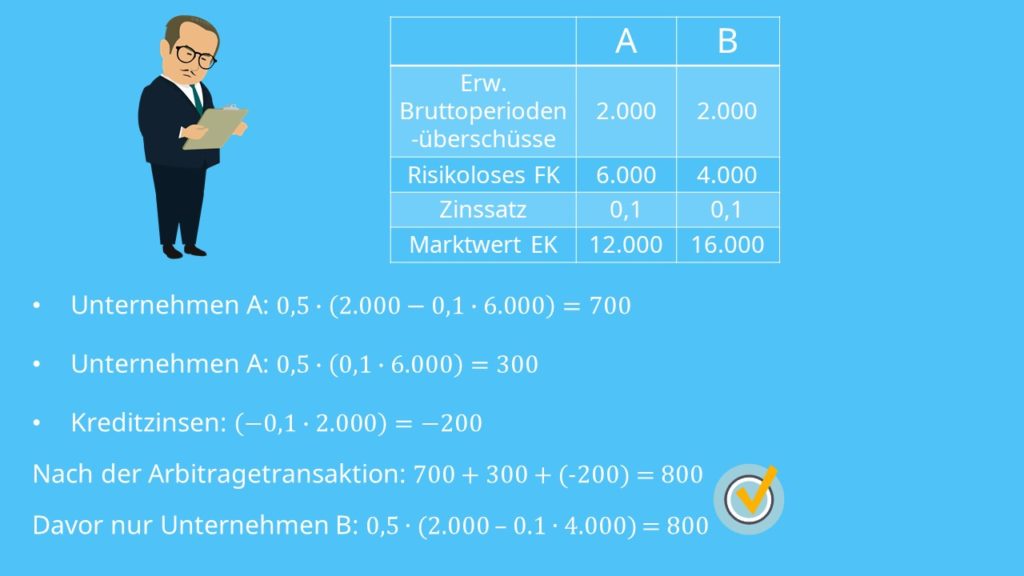

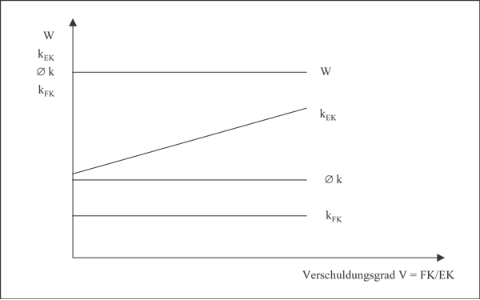

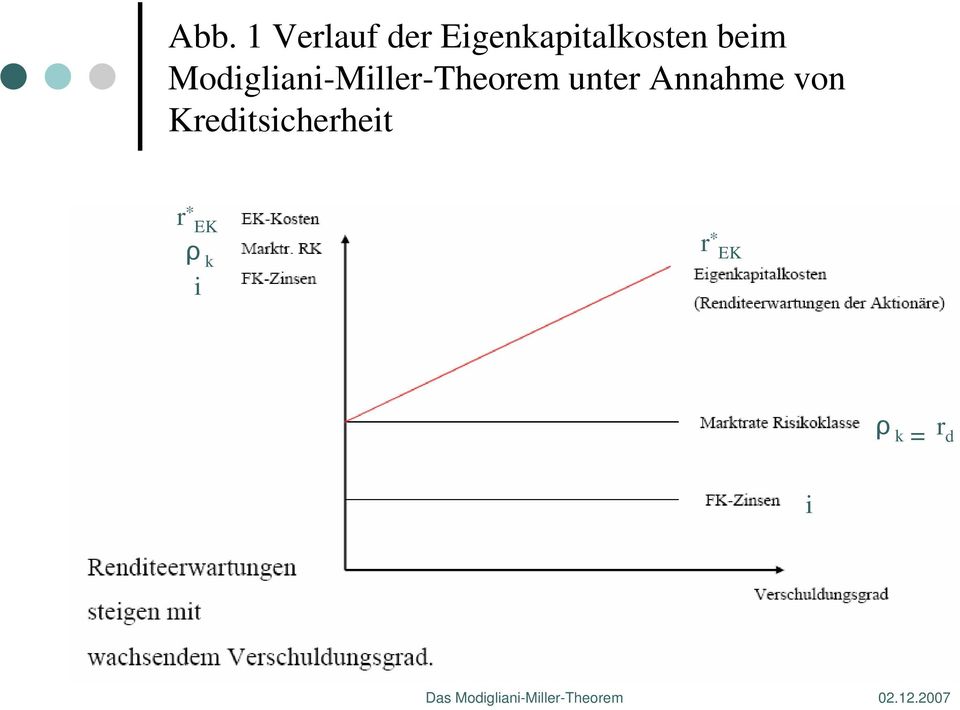

Variable costs were 60 percent of sales. It is based on the principle that all the assets belong to all the liability holdersThe BSM modeling framework gives the basic fundamental version of the structural model where default is assumed to. Erkenntnisse aus den Vorraussetzungen für den positiven Leverage Effekt.

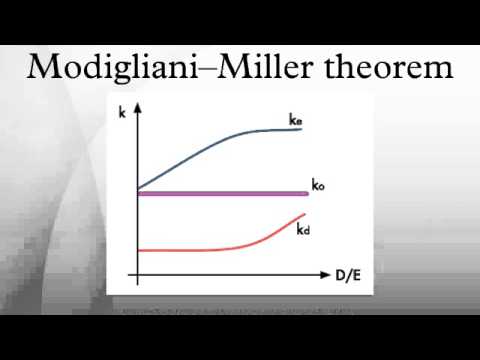

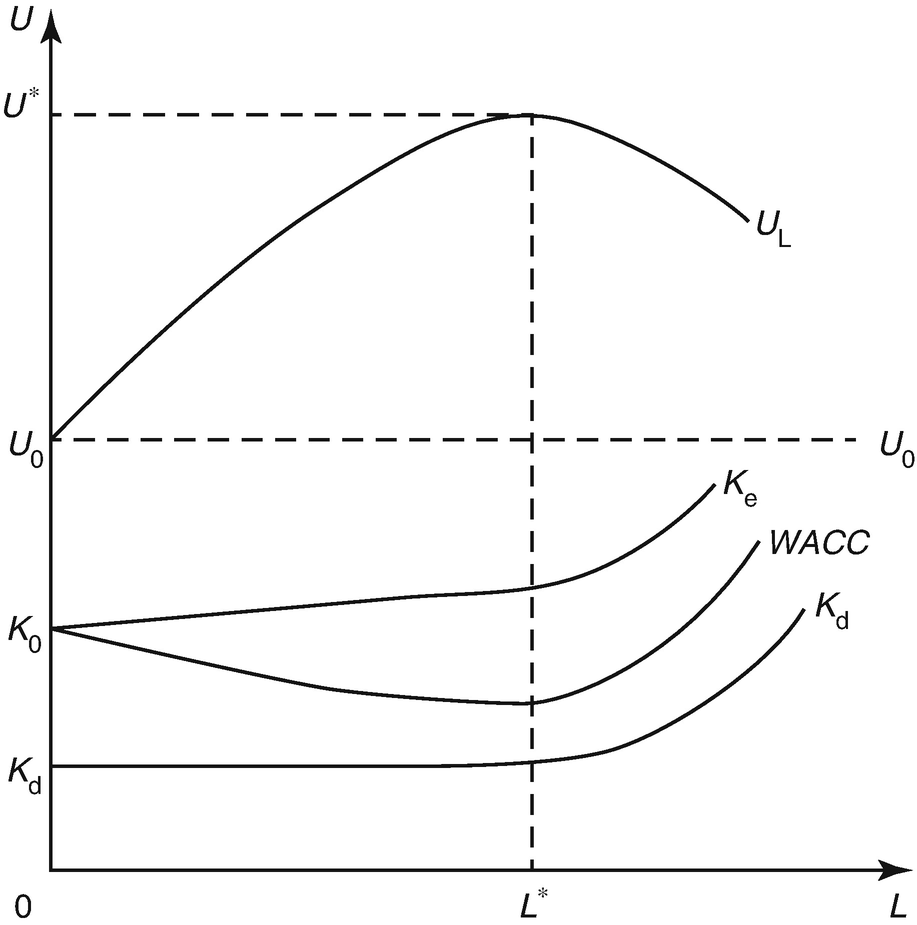

Voraussetzungen für positiven Leverage-Effekt. 2111 The Modigliani-Miller Theory with Taxes The essence of the initial MM Model proposed that under a perfect capital market with symmetry information and in the absence of taxes transaction cost and bankruptcy cost the market value of a firm is dependent on the capitalization of the firms expected return at a. Insured depositors have no incentive to demand yields that reflect the credit risk.

The first S-1s had terminals that allowed them to be wired in four fixed ways which would subtly alter their reproduction to emulate American British and German speakers. Of 6 male and 24 female clients had a mean age of 3150 years SD 999. 2 Hollin Corporation has bonds on the market with 165 years to maturity a YTM of 63 percent and a current price of 1036.

Get Free Chapter 1 The Modigliani Miller Propositions Taxes And conditions for payouts. The pricing of beta-sorted portfolios in these quartiles. Modigliani Miller These 1.

These 1 RR Rebutted and Rejointed shingles are 18 inches long 18 inch industry standard label true measurements may vary from 17 inch to 17 34 inch and come in a box of varying widths. 1 Watters Umbrella Corp. 1 What is business risk.

Issued 15-year bonds 2 years ago at a coupon rate of 88 percent. Therefore ebit totaled 400000. Integrated case campus deli inc.

It is financial theory stating that the market value of firm is. Optimal capital structure 14-18 assume that you have just been hired as business manager of campus deli cd which is located adjacent to the campus. Show S13-1 through S13-3 here Business risk is the riskiness inherent in the firms operations if it uses no debt.

Modigliani and Miller Theory modigliani and miller theory structure irrelevance definition. The Modigliani-Miller Theorem MM is a financial theory that believes that the market value of a company is determined by their earning power and the risk of their underlying assets and does not have anything to do with how an organization chooses to finance its investments whether it is debt or equity Ozyasar 2015. If as Modigliani and Miller 1958 suggest debt costs rise as equity falls it may be the case that banks are compensated for their extra capital by lower borrowing costs.

The final subject poo. Of these 1 subject was excluded because of incomplete thera-pist responses and 2 subjects were excluded because of low therapist ratings of confidence. 1996 Quarter 1 Practical Issues in Monetary Policy Targeting by Stephen G.

Was besagt das Fisher-Separationstheorem. A firms business risk is affected by many factors including these. A 1 square Carton will cover 100 Square feet at the recommended 14 inch double course exposure.

8 inch is the maximum recommended exposure for single course. If these bonds currently sell for 109 percent of par value what is the YTM. The slope of the solid line in Figure 1 denotes the price of risk implied by the pricing of the overall stock market relative to that of short-term bills ie the equity premium that a rational investor should have expected.

1 variability in the demand for its output 2 variability in the price at which its output can be sold 3. To test the ModiglianiMiller model of corporate financial structure. To construct any usable empirical.

The dashed line is the security market line the slope of which.

Modigliani Miller Theorem Youtube

What Is The Modigliani Miller Theorem Valuation Master Class

Erste Irrelevanzthese Nach Modigliani Miller Einfach Erklart Mit Video

Erste Irrelevanzthese Nach Modigliani Miller Einfach Erklart Mit Video

Capital Structure Modigliani Miller Theory Springerlink

Kapitalstrukturrisiko Und Arbitrageprozesse Die Modigliani Miller These Zur Optimalen Kapitalstruktur Chris Sebastian Heidrich Amazon De Bucher

Https Www Utilepaper Com Download File File 06729538 733f 4383 Ad8f Be13c88654ba Pdf

Verschuldungsgrad Richtig Verstehen Sicher Anwenden

Http Www Stendal Hs Magdeburg De Project Konjunktur Fiwi Vorlesung 7 Semester Vorlesungsmaterial Thema 15 Ws0708 Pdf

Capital Structure Modigliani Miller Theory Springerlink

Modigliani Miller Theories Of Capital Structure Assumptions Formula Graph Example Criticism

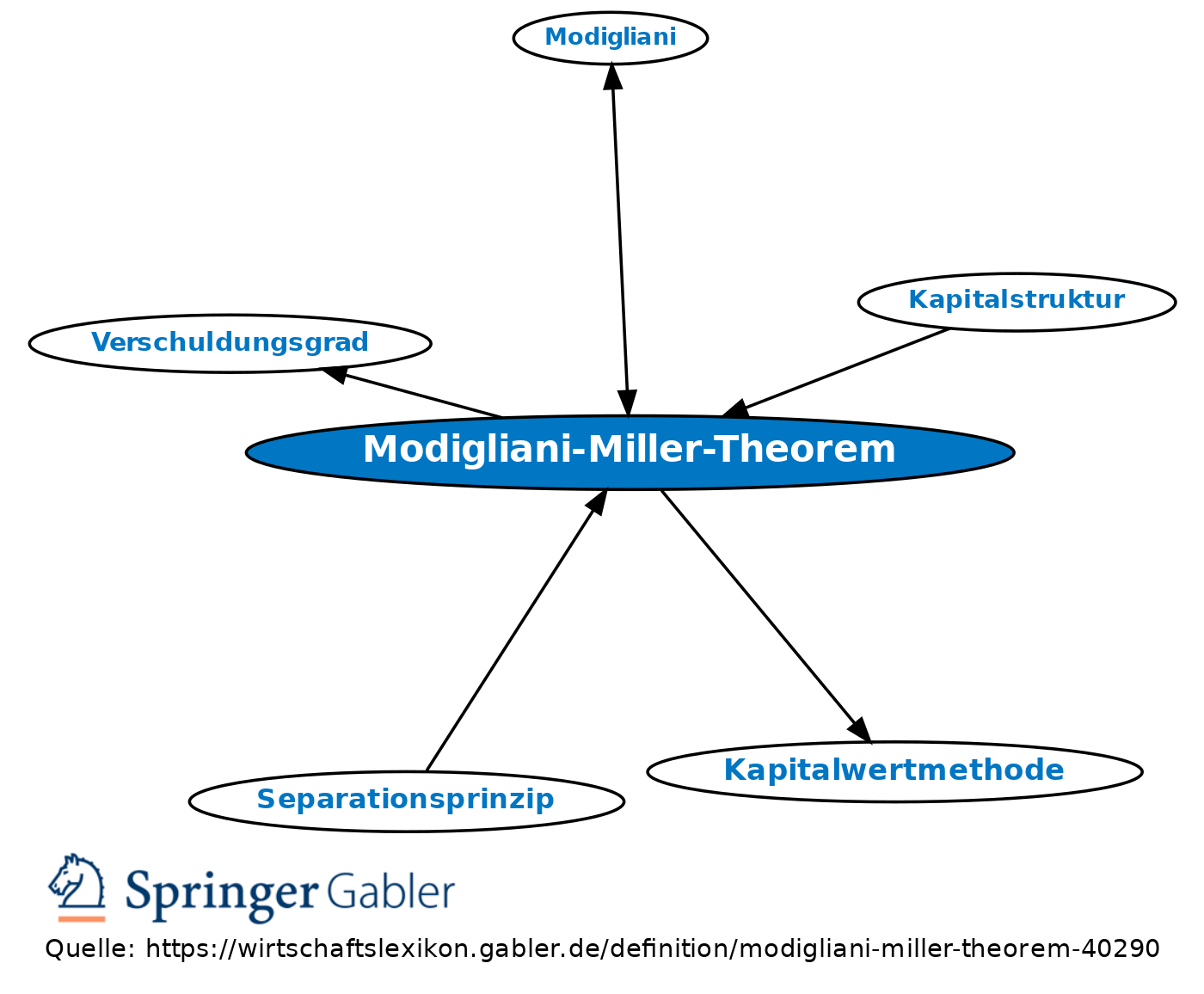

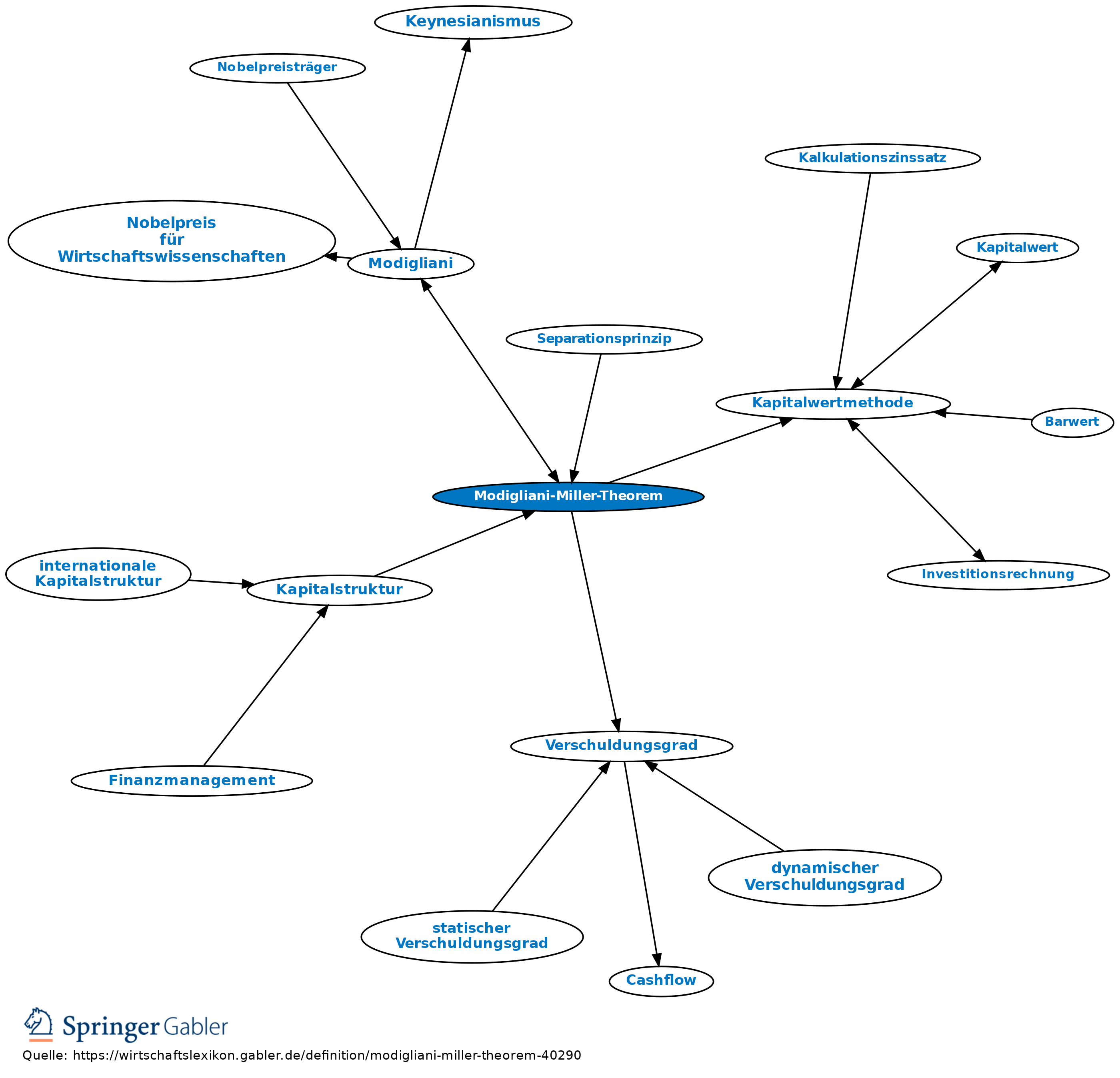

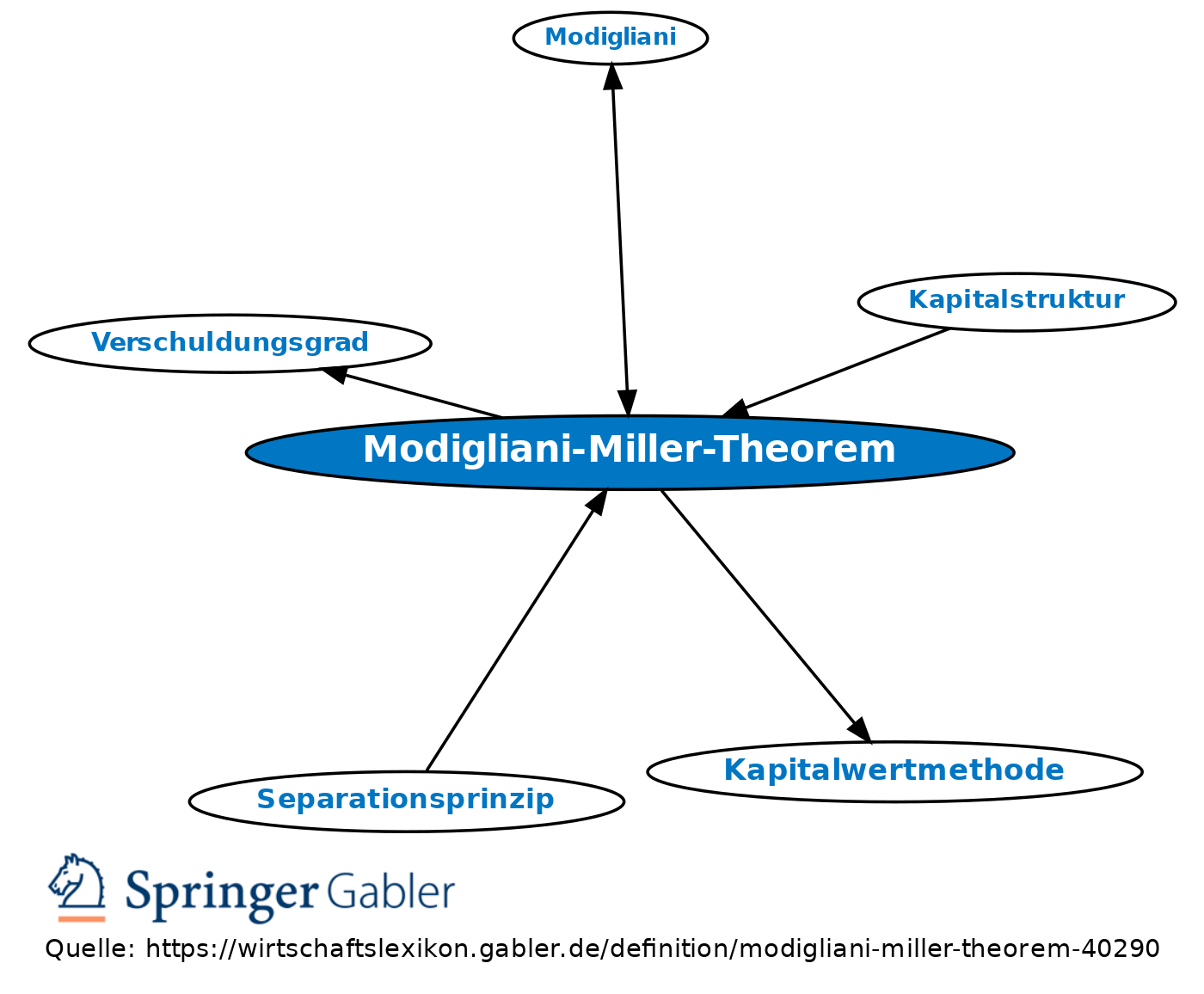

Modigliani Miller Theorem Definition Gabler Wirtschaftslexikon

Modigliani Miller Theorem Definition Gabler Wirtschaftslexikon

Das Modigliani Miller Theorem 7 Sem Finanzierung Bo Liu Ding Ma Pdf Kostenfreier Download

Modigliani Miller Theorem Wikipedia

Http Www Stendal Hs Magdeburg De Project Konjunktur Fiwi Vorlesung 7 Semester Vorlesungsmaterial Thema 15 Ws0708 Pdf

Kapitalstrukturrisiko Und Arbitrageprozesse Die Modigliani Miller These Zur Optimalen Kapitalstruktur Ebook By Chris Sebastian Heidrich 9783638193214 Rakuten Kobo Greece

Reproduced Figure 2 From Modigliani And Miller 1958 Download Scientific Diagram

Http Www Stendal Hs Magdeburg De Project Konjunktur Fiwi Vorlesung 7 Semester Vorlesungsmaterial Thema 2016 20modigliani Pdf

Post a Comment

Post a Comment